Three-Way Matching: The Purchase Order Superpower You’re Not Using

The Control Mechanism That Prevents Payment Fraud

You issued a purchase order for 100 widgets at £10 each. £1,000 total.

The supplier delivers 95 widgets.

The supplier invoices you for 100 widgets. £1,000.

Do you pay it?

Most businesses do. Because nobody’s checking.

This is the problem three-way matching solves. And if you’re not using it, you’re almost certainly paying for things you didn’t receive.

What Three-Way Matching Actually Is

Three-way matching compares three documents:

- Purchase Order (PO): What you agreed to buy

- Quantities

- Prices

- Items

- Goods Receipt (GR) or Delivery Note: What you actually received

- Quantities delivered

- Condition on arrival

- Delivery date

- Invoice: What the supplier is charging you

- Quantities invoiced

- Prices charged

- Amounts due

The matching process verifies:

- Did we order it? (PO exists)

- Did we receive it? (GR confirms)

- Are we being charged correctly? (Invoice matches PO and GR)

Only when all three match does payment process automatically.

Why This Matters More Than You Think

Prevents Overpayment: Supplier invoices for 100 units but only delivered 95. Without three-way matching, you pay for 100. You just lost £50.

Now multiply that across hundreds or thousands of invoices annually.

Catches Pricing Errors: PO shows £10 per unit. Invoice shows £12 per unit. Matching flags the discrepancy. You don’t overpay.

Prevents Duplicate Payments: Supplier sends invoice twice (it happens). Matching detects you already paid. You don’t pay again.

Stops Payment Fraud: Fake invoices for goods never ordered or received. Matching rejects them automatically.

Creates Accountability: Forces receiving department to record what actually arrived. No more “I think we got it.” You know.

Ready to let AI protect your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

What Manual Matching Looks Like (And Why Nobody Does It)

Traditional Process:

- Invoice arrives in Accounts Payable

- AP staff manually finds related PO

- AP staff manually finds goods receipt

- AP staff manually compares all three documents

- AP staff manually checks quantities, prices, calculations

- If discrepancies found, AP staff investigates

- If everything matches, AP processes payment

For one invoice: 10-15 minutes.

For 500 invoices monthly: 83-125 hours.

Reality: Nobody has time for this. So it doesn’t happen. Invoices get paid if they look reasonable. Controls are theoretical, not actual.

What Automated Three-Way Matching Looks Like

Modern Process:

- Invoice arrives (email, scan, upload)

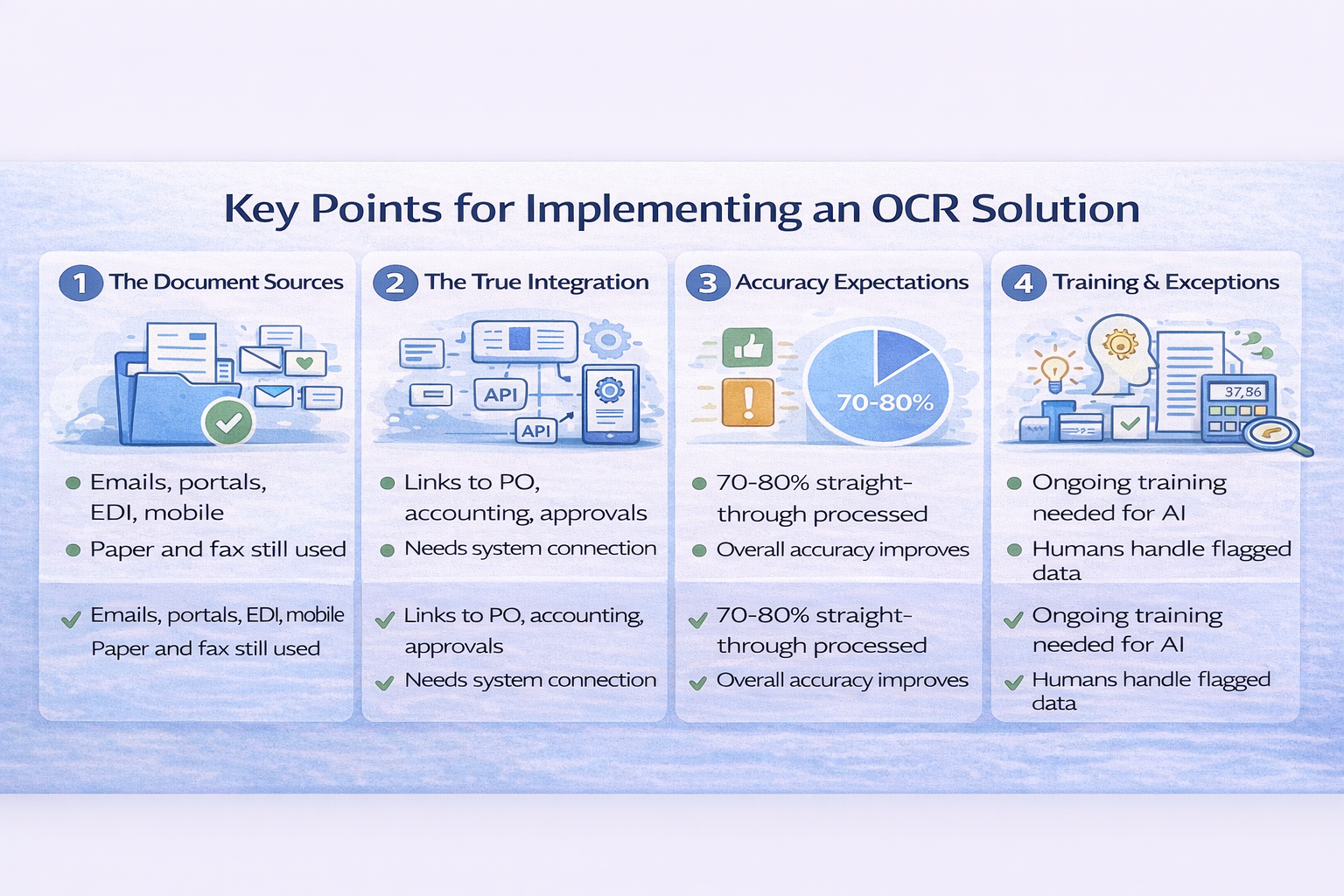

- OCR extracts invoice data automatically

- System automatically finds related PO

- System automatically finds goods receipt

- System automatically compares all three

- System automatically checks quantities, prices, calculations

- If everything matches: Payment processed automatically

- If discrepancies exist: Exception flagged for human review

For one invoice: 0 minutes (automatic) or 2 minutes (review exception).

For 500 invoices monthly: 0-10 hours total.

Only exceptions require human attention. Everything that matches processes automatically.

The Control Benefit

Three-way matching creates systematic controls that manual processes can’t sustain:

Preventive Control: Stops incorrect payments before they happen, not after.

Detective Control: Surfaces discrepancies that reveal deeper issues (supplier quality problems, receiving process failures).

Process Control: Forces discipline in purchasing and receiving. If goods receipt isn’t recorded properly, payment doesn’t process.

Audit Control: Creates complete audit trail. Every match (or mismatch) is logged and traceable.

The Integration Requirement

Automated three-way matching requires system integration:

Purchase Order System needs to connect to:

- Inventory/Receiving System (to capture goods receipts)

- Accounts Payable System (to process invoices)

- Payment System (to execute approved payments)

Data must flow automatically between these systems. If it doesn’t, matching becomes manual (and therefore doesn’t happen).

We build software that lets you enter data once and it updates all your business systems automatically. We also connect your existing systems so they share information with each other—payments, banking, accounting, CRM, the whole stack works together seamlessly.

The ROI Is Immediate

Before Three-Way Matching:

- Payment errors: 3-5% of invoice value

- £500,000 annual spend: £15,000-£25,000 in overpayments

- Fraud exposure: Unquantified but real

- Manual effort: 125 hours monthly reviewing invoices

After Three-Way Matching:

- Payment errors: <0.5% of invoice value

- £500,000 annual spend: £2,500 in errors (mostly legitimate disputes)

- Fraud exposure: Dramatically reduced

- Manual effort: 10 hours monthly reviewing exceptions

Annual benefit:

- £12,500-£22,500 fewer payment errors

- 115 hours monthly freed for higher-value work (£28,750 annually at £25/hour)

- Fraud prevention: Priceless

Total: £41,250-£51,250 annually

The Exception Management

Three-way matching creates exceptions. This is a feature, not a bug.

Common Exceptions:

Quantity Discrepancies: Ordered 100, received 95, invoiced for 100.

- Root cause: Supplier short-shipped

- Resolution: Request credit note or pay for 95 only

Price Discrepancies: PO shows £10/unit, invoice shows £12/unit.

- Root cause: Supplier price increase not authorised

- Resolution: Challenge invoice or get retroactive PO approval for higher price

Timing Discrepancies: Invoice arrives before goods receipt recorded.

- Root cause: Receiving team hasn’t logged delivery yet

- Resolution: Chase receiving team or wait for delivery confirmation

Item Discrepancies: Invoice includes items not on PO.

- Root cause: Supplier error or unauthorised additions

- Resolution: Challenge invoice or get retroactive PO

Each exception reveals a process improvement opportunity.

The AI Enhancement

Once three-way matching runs on clean, connected data, AI can:

Predict Exception Likelihood: “This supplier has 23% exception rate. Flag for priority review.”

Suggest Resolutions: “Historical pattern suggests this is delivery documentation delay. Delivery typically recorded within 2 days. Hold invoice for 48 hours before escalating.”

Identify Systemic Issues: “Supplier XYZ has price discrepancies on 47% of invoices. Suggests we need to renegotiate contract or update PO process.”

Optimize Matching Rules: “Invoices within 2% of PO value process without issue 99% of the time. Recommend auto-approval within this threshold.”

But only with clean data accumulating over time.

The Implementation Path

Phase 1: Manual Matching Implement discipline of manually matching key invoices. Painful but reveals where controls are needed.

Phase 2: Digital Records Digitise POs, goods receipts, and invoices. Makes matching possible even if still manual.

Phase 3: Automated Matching Connect systems so matching happens automatically. Immediately see time savings and error reduction.

Phase 4: AI Optimisation Layer in machine learning to optimise matching rules, predict exceptions, and continuously improve.

Each phase builds on the previous one.

The Common Objections

“Our suppliers are reliable. We trust them.” Mistakes aren’t malicious. They’re inevitable. Even good suppliers make errors.

“We don’t have time to implement this.” You’re currently spending 125 hours monthly on invoice processing. Three-way matching reduces that to 10 hours. The time investment pays back immediately.

“Our system doesn’t support three-way matching.” Then your system is holding your business back. This isn’t exotic functionality—it’s standard best practice.

“We’re too small to need this.” If you’re spending £200,000+ annually with suppliers, you’re losing £6,000-£10,000 annually to payment errors. That’s not nothing.

Ready to deploy AI protection across your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

The Competitive Advantage

Businesses with three-way matching:

- Pay faster (automated approvals)

- Pay accurately (errors caught automatically)

- Build better supplier relationships (fewer disputes)

- Scale without adding AP staff

- Have clean data for AI capabilities

Businesses without three-way matching:

- Pay slowly (manual reviews bottleneck)

- Pay inaccurately (errors go undetected)

- Frustrate suppliers (constant disputes)

- Add AP staff as volume grows

- Have messy data that blocks automation

Which business would you rather compete against?

The Real Question

It’s not whether you should implement three-way matching.

It’s why you haven’t already.

Every invoice processed without matching is:

- A potential overpayment

- A missed control opportunity

- An exposure to fraud

- A waste of manual effort

Ready to implement the purchase order superpower you’re not using?

Let’s discuss how automated three-way matching can prevent payment errors, free your team’s time, and create the financial controls your business deserves.

📅 Book a conversation: https://calendly.com/jiteshlakhani

📞 Call directly: 0207 031 9810