Real-Time Cashflow Intelligence: Making AI Forecasting Actually Simple

Cash flow forecasting shouldn’t require a PhD in data science or weeks of spreadsheet wrestling. Yet most businesses still struggle with complex models that are outdated before they’re finished. Here’s how to make it simple.

The End of Spreadsheet Hell: How to Build Cash Flow Forecasting That Actually Works (In Days, Not Months)

Every CFO has the same Monday morning ritual: Open multiple spreadsheets, log into five different systems, export last week’s data, update formulae that break half the time, and produce a cash flow forecast that’s obsolete by Wednesday. There’s a better way, and it’s surprisingly simple.

Why Traditional Forecasting Fails

Before we fix it, let’s acknowledge why current approaches don’t work:

- Data Decay: By the time you’ve collected data from all sources, the earliest data is already old

- Manual Errors: Every copy-paste, every formula update, every manual entry introduces potential mistakes

- Context Blindness: Spreadsheets show numbers but miss the story – why customers pay late, which invoices are at risk

- Update Paralysis: The process is so painful, most businesses only update monthly, missing critical changes

The solution isn’t working harder or building more complex spreadsheets. It’s eliminating the need for them entirely.

Ready to let AI protect your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

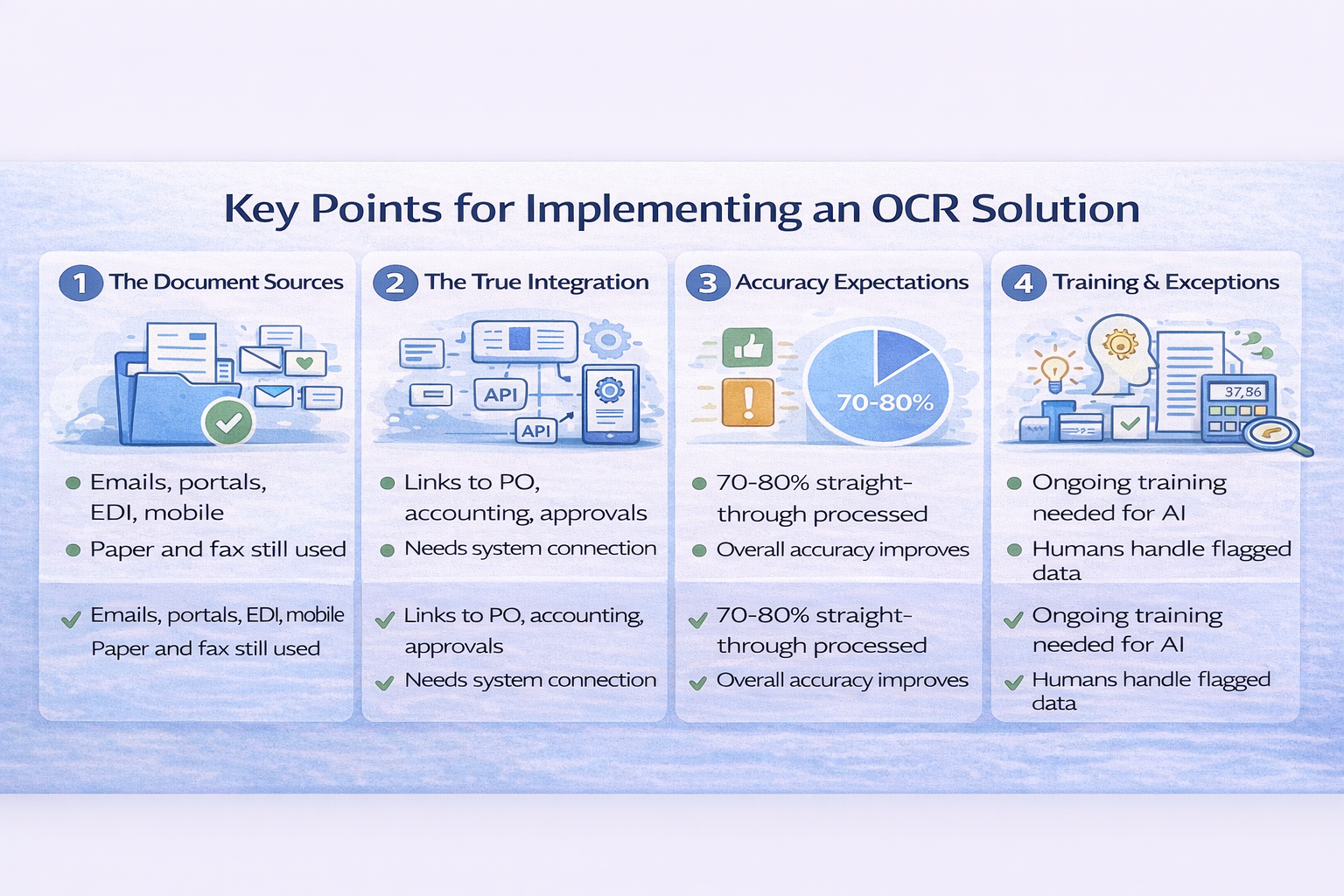

The Integration Revolution: One Entry, Everywhere

Here’s the fundamental shift: We create solutions where you enter information once and it flows everywhere it needs to go. When your business systems – payments, banking, accounting, CRM – actually communicate and share relevant data automatically, something magical happens. Forecasting stops being something you do and becomes something that happens.

Step 1: Connect Open Banking (30 Minutes)

Forget manual bank reconciliation. Open Banking feeds deliver real-time transaction data directly to your systems. Every payment, every receipt, every fee – flowing automatically into your forecasting engine.

Setting this up is simpler than you think:

- Authorise read-only access to your bank accounts

- Map transaction types to your categories

- Set up automated daily synchronisation

That’s it. Your bank data now flows without any manual intervention.

Step 2: Link Your Core Systems (2 Hours)

This is where most businesses get scared, imagining months of IT projects. Modern integration platforms make this surprisingly simple:

Accounting Integration: Your accounting software likely already has APIs. Connect it to receive bank feed data and share invoice/bill information.

Payment Platform Connection: Whether you use Stripe, PayPal, or traditional payment processors, automated connections can share transaction predictions and payment schedules.

CRM Synchronisation: Customer payment behaviour, communication history, and credit terms flow into your forecasting model, adding crucial context to raw numbers.

You don’t need to replace any systems. You’re just teaching them to talk to each other.

Step 3: Deploy AI Forecasting (Instant)

Once your data flows, AI forecasting isn’t complex – it’s automatic. Modern AI doesn’t need programming or configuration. It learns from your integrated data:

- Pattern Recognition: AI identifies how long each customer really takes to pay, not what the terms say

- Trend Analysis: Seasonal patterns, growth trends, and market conditions are automatically factored in

- Risk Detection: Unusual patterns trigger alerts before they become problems

- Scenario Modelling: AI runs thousands of what-if scenarios using your real data

The AI gets smarter with every transaction, continuously improving accuracy without any effort from you.

Ready to deploy AI protection across your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

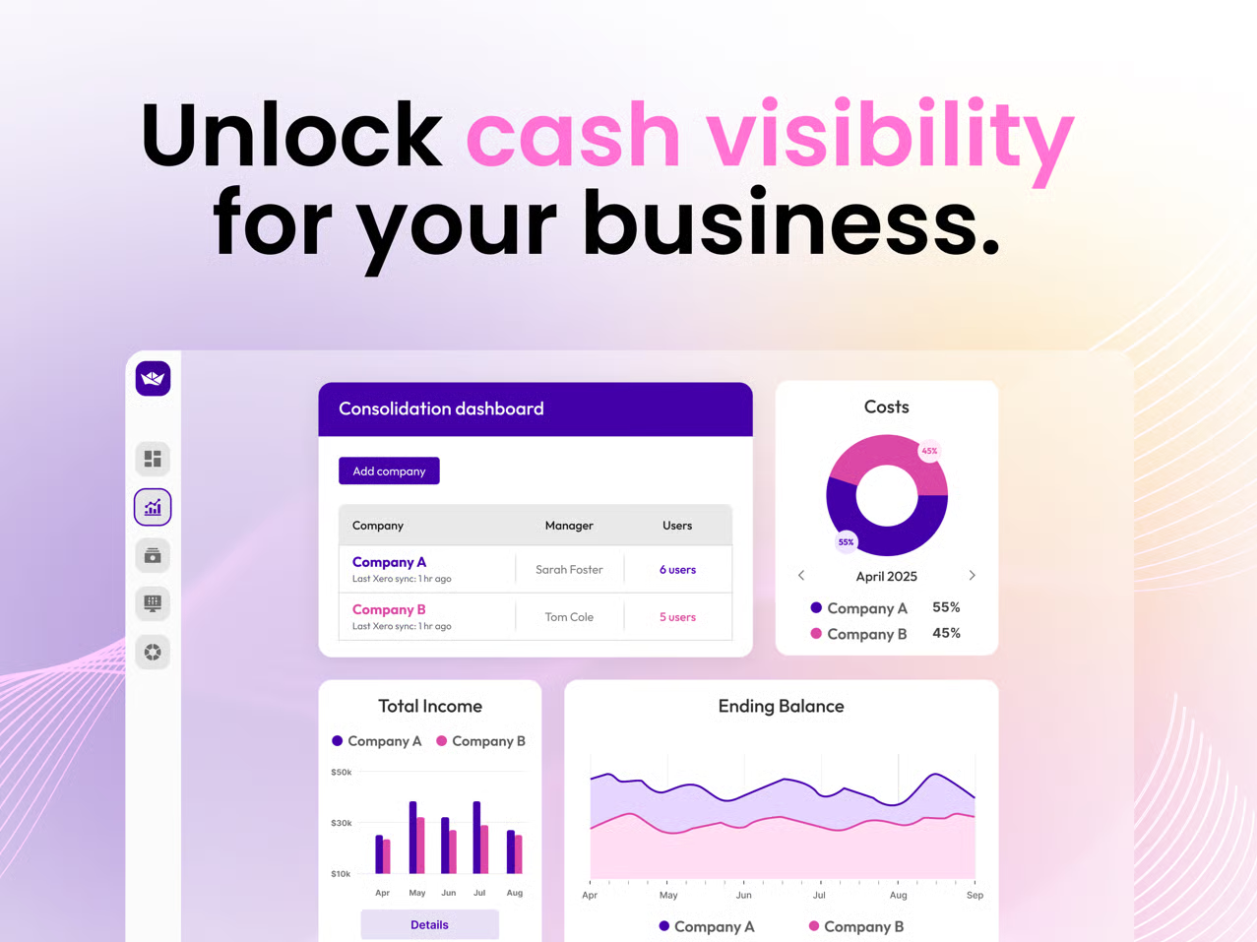

The Daily Reality: What Easy Actually Looks Like

Here’s what cash flow forecasting looks like when it’s truly easy:

Monday Morning (5 minutes): Open your dashboard. See your 30-day cash position with 90%+ accuracy. Review any AI-flagged risks. Done.

Customer Payment (0 minutes): Payment hits your bank. Automatically matched to invoice. Forecast updates. AI adjusts patterns. You don’t even know it happened.

New Invoice (10 seconds): Create invoice in your accounting system. AI immediately factors it into forecasts based on that customer’s actual payment history, not standard terms.

Supplier Bill (10 seconds): Enter bill once. AI automatically schedules optimal payment timing based on your cash position and early payment discounts.

Month End (15 minutes): Review AI-generated insights. Understand trends. Make strategic decisions. No data entry. No spreadsheet updates. No reconciliation.

The Hidden Benefits of Easy

When forecasting becomes effortless, unexpected advantages emerge:

Strategic Focus: Instead of building forecasts, you’re using them. More time for strategy, less time for spreadsheets.

Team Adoption: When tools are easy, people actually use them. No more shadow spreadsheets or parallel processes.

Faster Decisions: Real-time forecasts mean real-time decisions. Opportunities aren’t missed whilst waiting for month-end reports.

Reduced Stress: Knowing your cash position with confidence eliminates the anxiety of uncertainty.

Common Objections (And Why They’re Wrong)

“Our business is too complex” – AI handles complexity better than spreadsheets. More variables make AI more valuable, not less.

“We need custom calculations” – Modern platforms support custom rules whilst maintaining automation. You get flexibility without complexity.

“It’s too expensive” – Compare the cost to the hours spent monthly on manual forecasting. ROI is usually weeks, not years.

“We don’t trust AI” – You’re not replacing judgement with AI. You’re replacing data entry with AI. You still make the decisions, just with better information.

Getting Started This Week

Easy cash flow forecasting isn’t a six-month project. Most businesses can have basic integration running in days:

Day 1: Connect Open Banking feeds Day 2: Integrate accounting system Day 3: Link payment platforms Day 4: Connect CRM data Day 5: Review your first AI forecasts

The Competitive Edge of Easy

Whilst competitors wrestle with spreadsheets, you’re making decisions. Whilst they react to cash crunches, you prevent them. Whilst they guess at next month, you know next quarter.

Easy isn’t about being lazy. It’s about being smart. When forecasting runs itself, you can focus on what matters: growing your business with confidence.

Stop accepting that cash flow forecasting has to be hard. In a world where your systems can talk to each other and AI can process millions of calculations instantly, the only question is: Why are you still using spreadsheets?