Your CRM and Accounting System Should Be Best Friends

The Cold War Costing Your Business

Your CRM knows everything about your customers:

- Their contact details

- Communication history

- Deal stages

- Preferences and pain points

Your accounting system knows critical financial information:

- Payment history

- Outstanding invoices

- Credit terms

- Actual value delivered

But they don’t talk to each other.

This isn’t just inconvenient. It’s expensive, risky, and it’s holding your business back.

What Happens in the Disconnect

Your Sales Team: Chasing a deal with a customer who’s 90 days overdue on existing invoices. They don’t know because that information lives in accounting, not CRM.

Your Finance Team: Pursuing aggressive collection action on a customer who just placed a significant new order. They don’t know because that information lives in CRM, not accounting.

Your Customer: Receiving conflicting messages from different parts of your organisation. Confused, frustrated, and considering alternatives.

Your Business: Making decisions based on incomplete information, repeatedly.

Ready to let AI protect your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

The Data Re-Entry Treadmill

When CRM and accounting don’t connect:

- Sales closes a deal in CRM

- Someone manually creates the customer in accounting

- Someone generates an invoice

- Someone updates the CRM with invoice details

- Payment arrives

- Someone updates accounting

- Someone updates CRM with payment status

Seven steps. Multiple people. Countless opportunities for error.

And that’s just one deal.

The Real Cost

Direct Labour Cost: 5-10 minutes per transaction, multiple times daily. For a business closing 100 deals monthly, that’s 8-17 hours of pure duplication. £200-£425 monthly. £2,400-£5,100 annually. Just in data entry.

Error Cost:

- Wrong customer details in invoices

- Missing or inaccurate payment records

- Deals marked closed that weren’t invoiced

- Invoices issued for opportunities that fell through

Decision Cost: When sales doesn’t see payment history:

- Bad credit risks get extended terms

- Good customers get aggressive collection

- Revenue forecasts miss by significant margins

When finance doesn’t see sales pipeline:

- Cash flow projections lack critical forward visibility

- Credit decisions made without customer relationship context

- Collection approaches damage valuable relationships

What “Best Friends” Actually Looks Like

When your CRM and accounting system connect properly:

Deal Closes in CRM:

- Customer automatically created in accounting (if new)

- Invoice generated with correct details

- Deal marked as invoiced in CRM

- Both systems show consistent information

Payment Received:

- Accounting marks invoice as paid

- CRM automatically updates deal status

- Sales team sees payment confirmation

- Customer record reflects current payment status

Payment Delayed:

- Accounting flags overdue invoice

- CRM shows alert to account manager

- Account manager reaches out proactively

- Context-aware conversation: “I noticed payment is delayed. Is everything okay with the delivery?”

We build software that lets you enter data once and it updates all your business systems automatically. We also connect your existing systems so they share information with each other—payments, banking, accounting, CRM, the whole stack works together seamlessly.

The Business Intelligence Multiplier

When CRM and accounting share data, you unlock insights neither system can provide alone:

Customer Lifetime Value (Real, Not Estimated): CRM knows deal history and pipeline. Accounting knows actual payments and profitability. Together: true CLV that informs acquisition spending.

Predictive Payment Behaviour: Pattern recognition across customer interactions (CRM) and payment history (accounting) predicts which invoices will pay on time and which need attention.

Sales Performance Reality: Measuring sales performance on closed deals (CRM only) is incomplete. Measuring on actual collected revenue (CRM + accounting) is accurate. The difference matters for compensation and forecasting.

Customer Health Scoring: Combining engagement data (CRM) with payment behaviour (accounting) creates accurate customer health scores. You can intervene before relationships deteriorate.

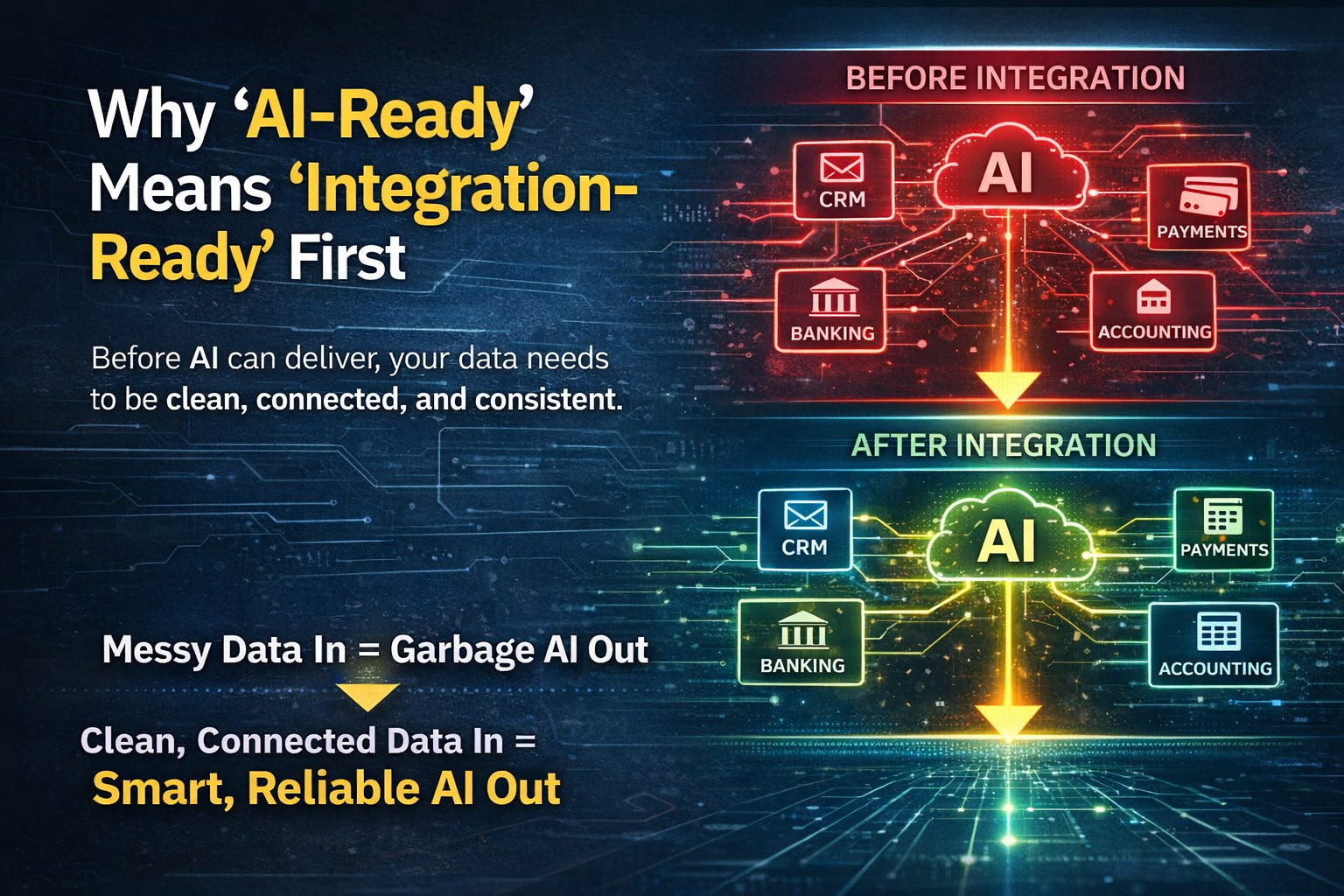

The AI Opportunity

Clean, connected data between CRM and accounting becomes the foundation for AI that actually helps:

AI can recommend:

- Credit terms based on complete customer picture

- Optimal contact timing for collections

- At-risk customers before they churn

- Upsell opportunities with financially healthy customers

AI can automate:

- Routine invoicing based on CRM deal stages

- Payment reminders with appropriate tone based on customer relationship

- Escalation paths that consider both financial and relationship factors

But only if the data is connected, consistent, and accurate.

Ready to deploy AI protection across your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

The Implementation Path

You don’t need to build this from scratch.

Option 1: Platform Approach Some modern platforms include both CRM and accounting. Everything’s connected by design. Trade-off: you might sacrifice best-of-breed functionality in each area.

Option 2: Integration Approach Keep your existing CRM and accounting systems, but connect them so they share information automatically. You get best-of-breed tools that work together seamlessly.

We specialise in the second approach: connecting your existing systems so they communicate automatically whilst letting you keep the tools that work best for your business.

The Cultural Bridge

Connected systems also bridge organisational gaps.

Sales and Finance Often Don’t Collaborate Well: Sales wants to close deals. Finance wants to protect cash and margins. When they work from different information sources, this tension escalates.

Shared Data Creates Shared Understanding: When both teams see the same complete picture, conversations shift from territorial to collaborative. “How do we serve this customer profitably?” instead of “Why won’t you let me close this deal?”

The Question

If your CRM and accounting system were people, would they be:

- Best friends sharing everything?

- Distant acquaintances who occasionally nod in passing?

- Complete strangers unaware the other exists?

Most businesses are somewhere between the second and third option.

Every day they stay disconnected is a day you’re:

- Duplicating data entry

- Accumulating errors

- Making decisions with incomplete information

- Missing opportunities

- Frustrating customers

- Limiting what AI can do for you

Ready to make your CRM and accounting system best friends?

Let’s discuss how connecting these critical systems eliminates duplication, improves decisions, and unlocks capabilities neither system can deliver alone.

📅 Book a conversation: https://calendly.com/jiteshlakhani

📞 Call directly: 0207 031 9810