Purchase Order 2.0: The End of Manual Approvals and Expense Chaos

Purchase Order 2.0: How Integrated Automation Turns Procurement from Cost Centre to Profit Driver

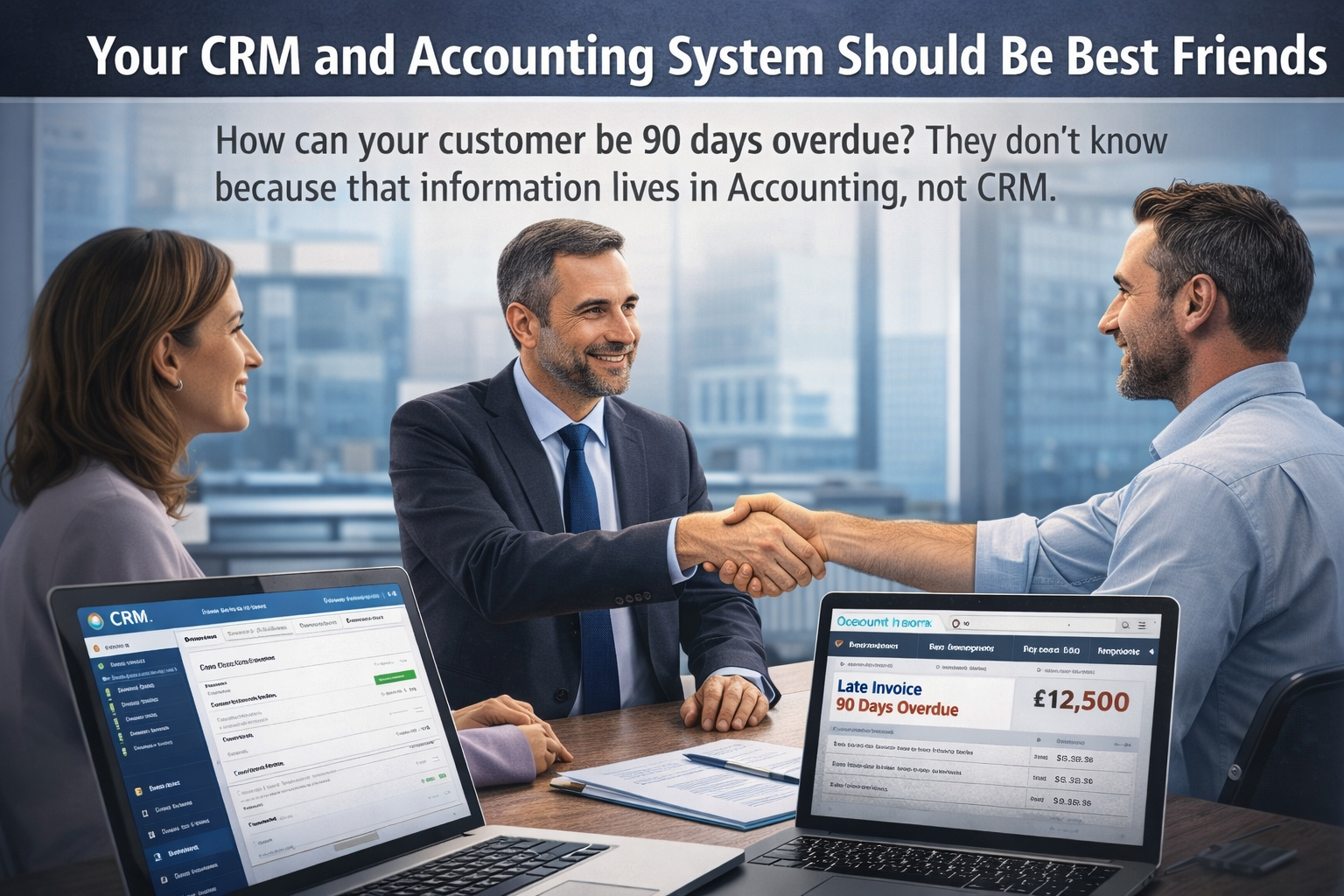

Picture Monday morning in your finance department: Sarah is manually matching 200 invoices to POs. James is chasing credit card receipts from last month. Emma is trying to figure out why the same supplier was paid three times for the same service by different departments. Meanwhile, the CFO wants to know why spending is 30% over budget, but no one can answer because the data lives in six different systems.

This isn’t a process problem. It’s an integration crisis that’s costing UK businesses billions in inefficiency, fraud, and missed savings opportunities.

The True Cost of Disconnected Procurement

Let’s quantify what manual purchase order processing really costs:

- Processing time: 15-30 minutes per PO manually

- Three-way matching: 20 minutes per invoice

- Credit card reconciliation: 5 hours per 100 transactions

- Duplicate payments: 2% of total spend

- Maverick spending: 20-30% of purchases outside approved processes

- Missed discounts: 2% early payment discounts lost

For a mid-size business processing 500 POs monthly, that’s £200,000+ in annual waste.

The Integration Revolution

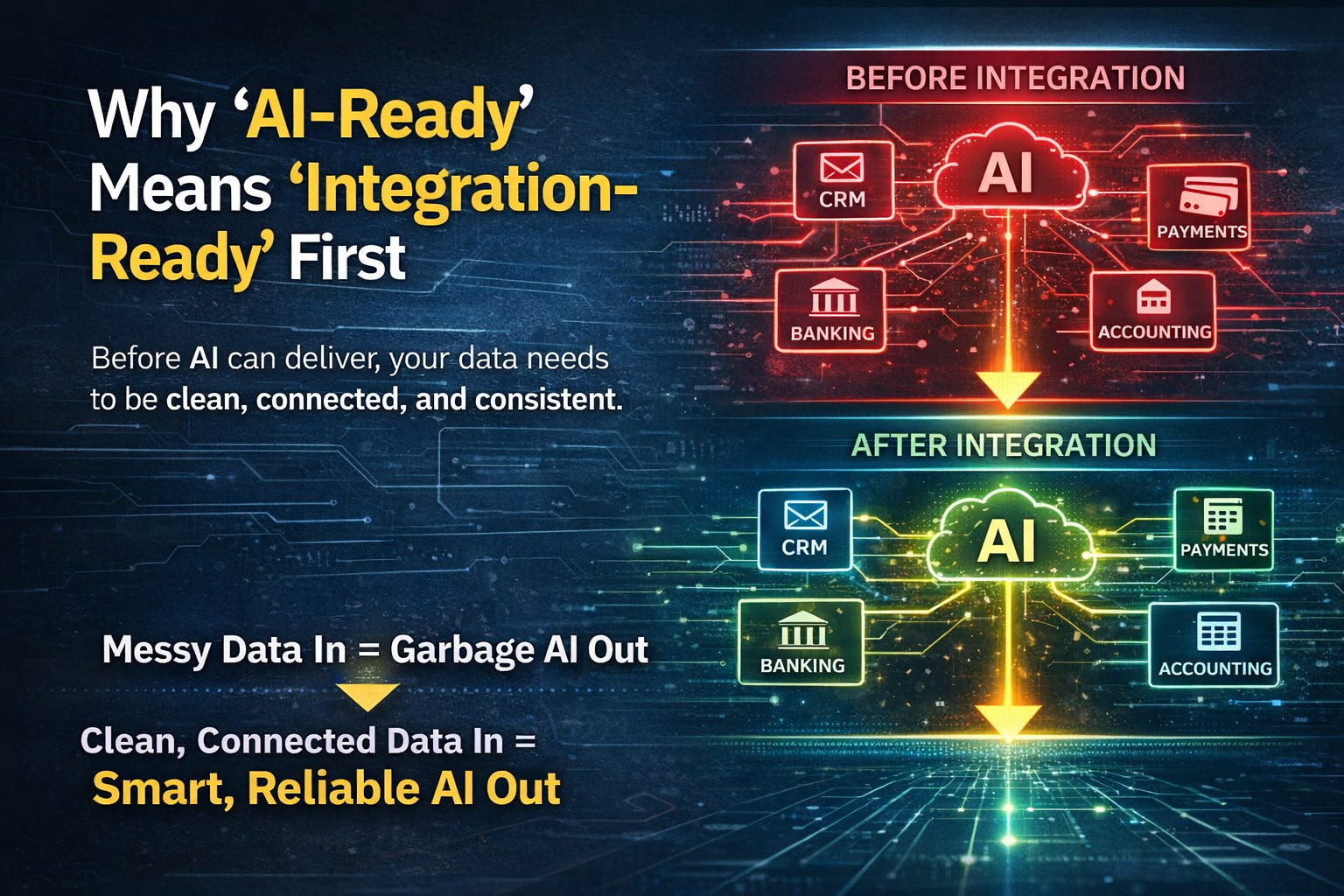

Here’s the breakthrough: We create solutions where you enter information once and it flows everywhere it needs to go. Plus, we connect all your existing business systems – purchase orders, credit cards, expense platforms, accounting, banking – so they actually communicate and share relevant data automatically.

This isn’t about replacing your systems. It’s about making them work as one.

Ready to let AI protect your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

The Complete Purchase-to-Pay Ecosystem

Unified Requisition (One Entry Point) Employee needs something. They enter it once – whether it’s a PO request, credit card pre-authorisation, or expense claim. The system knows:

- Budget availability across all spending channels

- Preferred suppliers and negotiated rates

- Approval requirements based on amount and category

- Compliance requirements for the purchase type

Intelligent Approval Orchestration Instead of different approval processes for different systems:

- Dynamic routing: £50 Amazon purchase on credit card follows same rules as £50 PO

- Parallel approvals: Multiple approvers notified simultaneously

- Mobile authorisation: Approve POs and expenses from anywhere

- Delegation rules: Automatic rerouting when someone’s away

- Budget integration: Real-time budget checks before approval

Vendor Risk Management 2.0 Every purchase triggers automated checks:

- Internal history: Past performance, quality issues, payment terms

- Financial health: Credit scores, Companies House filings

- Compliance verification: Insurance, certifications, modern slavery statements

- Duplicate detection: Same vendor, different names across systems

- Spend analysis: Concentration risk, contract compliance

The Credit Card Revolution

Business credit cards become procurement tools, not procurement problems:

Pre-Purchase Control

- Virtual cards generated for specific POs

- Spending limits matched to approved amounts

- Merchant category restrictions enforced

- Automatic card freeze for non-compliant purchases

Real-Time Matching

- Card transaction hits → System matches to PO → Marks as received

- No PO match → Alert sent → Employee provides justification

- Receipt uploaded via mobile → Automatically attached to transaction

- VAT extracted → Reclaim prepared automatically

Expense Platform Synchronisation

- Expenses submitted in Expensify/Concur flow to PO system

- Duplicate detection across POs and expenses

- Unified reporting of all spending methods

- Single approval workflow regardless of platform

Three-Way Matching That Actually Works

Traditional three-way matching is a joke – by the time you match PO, receipt, and invoice, the supplier’s already calling about payment.

Automated matching changes everything:

- PO Created: Terms, quantities, prices locked in system

- Goods Received: Warehouse scans barcode or employee confirms receipt digitally

- Invoice Arrives: OCR captures data, AI matches to PO

- Automatic Validation: Quantities, prices, terms checked instantly

- Exception Only: Humans only see mismatches requiring attention

Result: 95% of invoices process without human touch. 100% accuracy. Zero duplicate payments.

The Data Intelligence Layer

When everything connects, AI transforms procurement:

Predictive Analytics

- Demand forecasting based on historical patterns

- Price trend analysis across suppliers

- Optimal order timing for best prices

- Cash flow impact modelling

Spend Optimisation

- Identify consolidation opportunities

- Spot contract leakage

- Suggest alternative suppliers

- Negotiate better terms with data

Risk Prevention

- Unusual spending patterns flagged

- Potential fraud detected across systems

- Supplier problems predicted before they impact

- Budget overruns prevented, not reported

Real-World Implementation

Week 1: Foundation

- Map current procurement processes

- Identify all spending systems (you’ll find more than expected)

- Connect core PO and accounting systems

- Establish unified approval matrix

Week 2: Integration

- Link credit card feeds

- Connect expense platforms

- Integrate vendor databases

- Set up three-way matching rules

Week 3: Automation

- Configure approval workflows

- Build exception handling

- Create mobile interfaces

- Enable receipt capture

Week 4: Intelligence

- Deploy spending analytics

- Activate risk monitoring

- Enable predictive insights

- Train AI on your patterns

Ready to deploy AI protection across your procurement?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

Success Stories

Manufacturing Company: Integrated SAP POs with Barclaycard and Expensify. Result: 75% reduction in processing time, annual savings from eliminated duplicates.

Professional Services Firm: Connected Coupa, American Express, and Concur. Outcome: Maverick spending dropped from 30% to 5%, saving six digits annually.

Retail Chain: Unified POs across 50 locations with corporate cards. Discovery: Duplicate spends which by pass the PO requirements for vendor agreed pricing and excess stock which is not requred

Breaking Down Objections

“Our procurement is too complex” – Complexity makes integration more valuable, not less. More touchpoints mean more efficiency gains.

“Different departments need different processes” – Integration allows flexible rules whilst maintaining central control. Customise without chaos.

“Credit cards can’t be controlled” – Modern integration provides better control than taking cards away. Monitor and manage in real-time.

“Change management will be difficult” – When systems are easier, adoption follows. No one misses manual three-way matching.

The Competitive Advantage

Whilst competitors drown in manual processing:

- You see every pound committed before it’s spent

- Suppliers are vetted automatically

- Invoices process themselves

- Credit card spending follows PO disciplines

- Complete visibility across all spending channels

The Strategic Imperative

This isn’t about making procurement easier (though it does). It’s about transforming procurement from a cost centre to a strategic advantage. When every purchase flows through integrated intelligence, you don’t just save money – you make better decisions, faster.

The technology exists. The integrations are proven. The only question is: How much longer will you accept manual processes that your competitors are automating away?