Article 1: Account-to-Account Payments

Why AI need Account-to-Account Payments to Power accurate AI. What is Smart Data Integration

Account-to-account (A2A) payments are transforming how businesses move money, but here’s what most people miss: without proper data integration, even the most sophisticated payment systems become AI’s blind spot.

Think about it. Every A2A payment generates valuable data points – transaction amounts, timing patterns, vendor relationships, cash flow cycles. But if this data sits isolated in your payment system while your CRM tracks customer behavior separately and your accounting software holds invoice data in another silo, your AI can only see fragments of the story.

The Integration Advantage

When you enter payment information once and it flows everywhere it needs to go – updating your banking, accounting, CRM, and forecasting systems automatically – something powerful happens. Your AI suddenly has context. It knows that the £50,000 payment isn’t just a transaction; it’s from your biggest client who always pays 15 days early, triggers a supplier payment cycle, and affects next quarter’s growth projections.

This connected data ecosystem transforms A2A payments from simple transfers into intelligence goldmines. AI can now:

- Predict payment delays before they happen

- Optimize payment timing for cash flow

- Identify fraud patterns across multiple touchpoints

- Automate reconciliation with 99%+ accuracy

The Accuracy Multiplier

Here’s the game-changer: integrated data doesn’t just add information – it validates it. When your payment system talks to your bank feed, which confirms with your accounting software, you eliminate the human errors that corrupt AI training data. Clean, verified, real-time data means AI predictions you can actually trust.

The businesses winning with A2A payments aren’t just adopting faster payment rails. They’re building integrated data infrastructures where payment intelligence flows seamlessly across every system, creating the foundation for AI that actually works.

Stop letting your payment data live in isolation. When your systems truly talk to each other, your AI can finally see the complete picture.

The Hidden Revolution: How Integrated A2A Payment Data Is Becoming AI’s Secret Weapon

Account-to-account payments promised to revolutionize business transactions. Faster settlements, lower costs, enhanced security – the benefits are clear. But there’s a hidden revolution happening beneath the surface that’s far more transformative: integrated A2A payment data is becoming the foundation for AI systems that can actually deliver on their promises.

The Data Silo Problem Nobody Talks About

Here’s a scenario every CFO knows: Your business processes hundreds of A2A payments daily. Your payment platform tracks the transactions. Your bank records the debits and credits. Your accounting software manages invoices. Your CRM notes customer payment behavior. Each system holds a piece of the puzzle, but none see the complete picture.

This fragmentation isn’t just inefficient – it’s crippling your AI’s potential. Machine learning models trained on partial data produce partial insights. They might predict payment timing based on historical transactions but miss the customer communication in your CRM indicating financial difficulties. They might flag unusual payment amounts without knowing about the contract modification logged in your enterprise system.

Enter the Integration Advantage

Imagine a different reality: You enter payment information once, and it flows everywhere it needs to go. Your A2A payment doesn’t just move money – it triggers a cascade of synchronized updates across your entire business ecosystem. Banking systems, accounting platforms, CRM databases, inventory management – they all receive relevant data automatically, in real-time.

This isn’t just about efficiency. It’s about creating a unified data fabric that AI can actually navigate. When payment data is integrated with:

- Customer relationship data: AI understands payment behavior in context of communication patterns, support tickets, and engagement metrics

- Financial systems: Real-time reconciliation enables instant cash position updates and accurate forecasting

- Operational platforms: Payment triggers can automatically update inventory, initiate fulfillment, or adjust production schedules

- Risk management tools: Comprehensive transaction views enable sophisticated fraud detection across multiple vectors

Are you ready to integrate AI into your business?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

The Accuracy Transformation

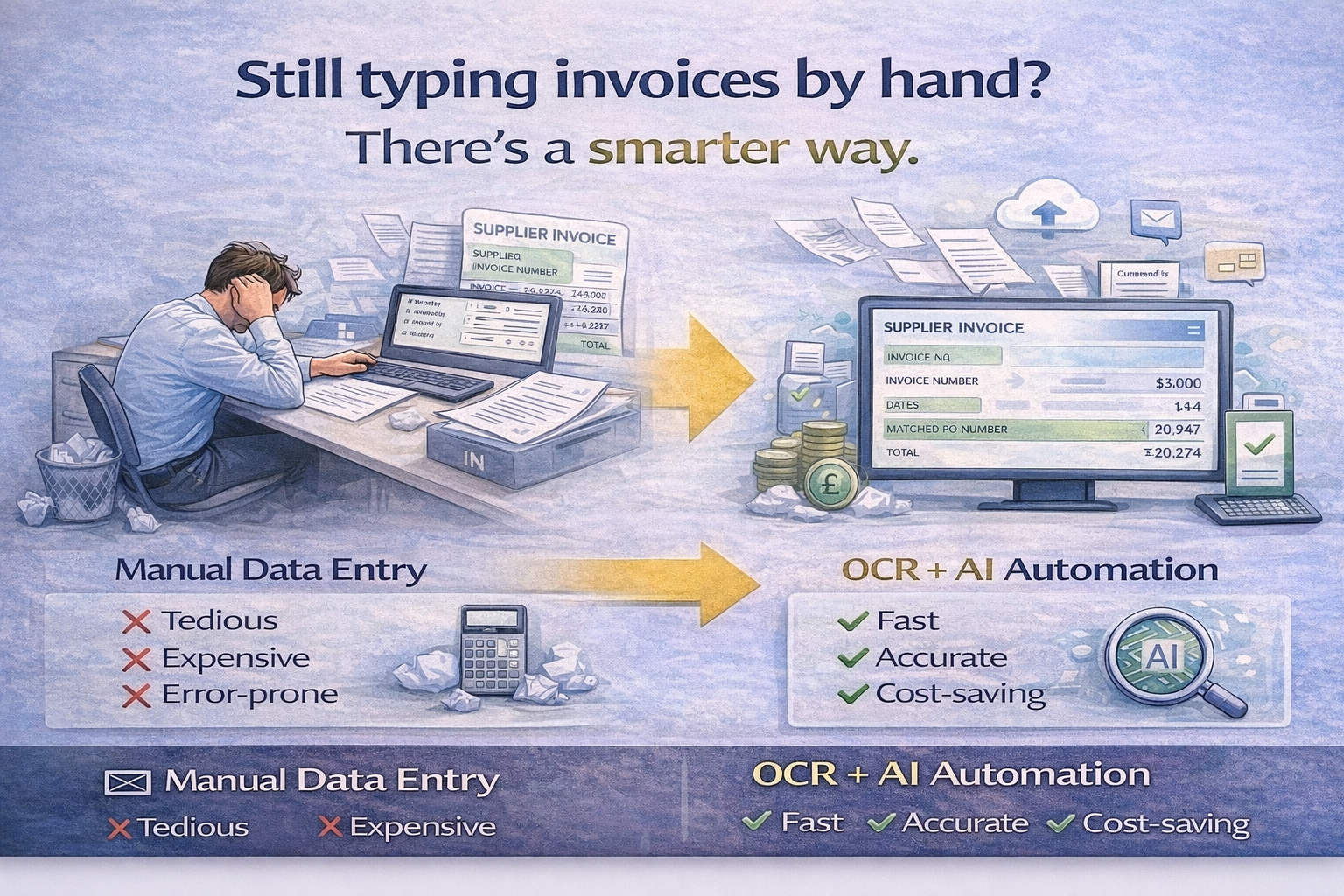

The real magic happens in data accuracy. Manual data entry has an error rate of 1-5%. When you’re processing thousands of transactions, that’s hundreds of incorrect data points poisoning your AI models. But when systems communicate automatically, when payment data flows directly from source to destination without human intervention, error rates plummet to near zero.

Consider the compound effect: Your payment system confirms the transaction with your bank feed. Your bank feed validates against your accounting records. Your accounting system cross-references with your CRM. Each validation strengthens data integrity. The result? AI models trained on verified, multi-source validated data that produce predictions you can stake your business on.

Real-World AI Applications That Actually Work

With integrated A2A payment data, AI transforms from buzzword to business advantage:

Predictive Cash Flow Management: Instead of basic trend analysis, AI sees the full context – payment histories, customer health scores, seasonal patterns, even email sentiment analysis. It predicts not just when payments will arrive, but why they might be delayed and what actions could accelerate them.

Intelligent Payment Routing: AI optimizes payment paths in real-time, considering bank relationships, currency fluctuations, regulatory requirements, and cash positioning across multiple accounts – all because it has complete visibility.

Automated Fraud Detection: Suspicious patterns emerge not from payment data alone, but from discrepancies across systems – unusual payment amounts combined with atypical login patterns, new beneficiaries added during off-hours, or payments that don’t match communication history.

Dynamic Credit Decisions: When payment behavior integrates with operational data, AI can adjust credit terms in real-time, extending terms for reliable partners during growth phases or tightening them when early warning signals appear across multiple systems.

The Implementation Reality

Building this integrated ecosystem isn’t about ripping and replacing existing systems. Modern integration platforms can connect your current infrastructure, creating bridges between systems that were never designed to talk to each other. APIs, webhooks, and intelligent middleware transform isolated databases into a connected intelligence network.

The key is starting with payment data as the backbone. A2A payments touch every part of your business, making them the perfect integration catalyst. Once payment data flows seamlessly, adding additional connections becomes progressively easier, creating a network effect that amplifies value with each new integration.

The Competitive Imperative

Businesses still managing A2A payments in isolation are competing with one hand tied behind their back. While they reconcile manually and make decisions on partial data, integrated organizations are leveraging AI to predict, optimize, and automate at scales previously impossible.

The question isn’t whether to integrate your A2A payment data – it’s how quickly you can do it. Because in a world where AI advantage determines market winners, the quality of your data integration directly correlates to the quality of your business decisions.

The future belongs to businesses that understand a simple truth: A2A payments aren’t just about moving money faster. They’re about creating integrated data ecosystems where every transaction enriches AI intelligence, driving decisions that are faster, smarter, and more accurate than ever before.

Are you ready to integrate AI into your business?

Contact Systematics Software Ltd today to explore how AI-powered solutions can revolutionise your operations and prepare you for the future of technology.

Nam aliquet ante porta, gravida elit, at fringilla felis suscipit.

Article 2: Cash Flow Forecasting AI

Why Your Cash Flow AI Is Only As Smart As Your Data Integration

Every CFO wants AI that can accurately predict cash flow. But here’s the uncomfortable truth: most cash flow forecasting AI fails not because the algorithms aren’t sophisticated enough, but because the data feeding them is fragmented, delayed, and often wrong.

Real-time cash flow intelligence requires real-time data integration. When your banking feeds, payment systems, accounting software, and CRM operate in silos, your AI is essentially trying to forecast the future while looking through a kaleidoscope – lots of pretty patterns, but no clear picture.

The Open Banking Game-Changer

Open Banking was supposed to solve this. Direct bank feeds. Real-time transaction data. Instant balance updates. But without intelligent integration, it just creates another silo – a very fast, very accurate silo that still doesn’t talk to your other systems.

The breakthrough comes when you create solutions where information entered once flows everywhere it needs to go. When that Open Banking feed automatically updates your accounting system, triggers alerts in your CRM, adjusts forecasts in your planning tools, and updates dashboards in real-time, you’ve moved from data collection to data intelligence.

Fusing Feeds with Forecasting

Here’s where it gets powerful. When Open Banking feeds integrate seamlessly with your business systems, AI can correlate:

- Real-time bank balances with outstanding invoices

- Payment patterns with customer communication

- Seasonal trends with actual transaction timing

- Supplier payment schedules with incoming cash positions

This fusion transforms forecasting from educated guessing to precision prediction. AI trained on integrated, validated, real-time data can spot patterns humans would never see – like how customer support ticket sentiment correlates with payment delays, or how certain email phrases predict early payment.

The Accuracy Revolution

Integration doesn’t just provide more data – it provides validated data. When multiple systems confirm the same information, error rates plummet. Your AI stops learning from mistakes and starts learning from truth.

The result? Cash flow forecasts with 90%+ accuracy extending weeks into the future, not days. Automated alerts before problems occur, not after. Strategic decisions based on what will happen, not what might happen.

Stop feeding your AI fragments. Give it the complete, integrated picture it needs to transform cash flow forecasting from an art into a science.

Real-Time Cashflow Intelligence: How Integrated Open Banking and AI Are Rewriting the Rules of Financial Forecasting

The promise of AI-powered cash flow forecasting has been tantalizing businesses for years. Imagine knowing your exact cash position 30, 60, even 90 days into the future. Imagine preventing cash crunches before they happen. Imagine optimizing working capital automatically. The technology exists – so why are most businesses still flying blind?

The answer isn’t in the AI algorithms or the Open Banking feeds. It’s in the gap between them.

The Integration Gap That Kills Forecasting Accuracy

Open Banking revolutionized access to financial data. Real-time balances, instant transaction feeds, and direct bank connectivity eliminated the delays and errors of manual bank reconciliation. Meanwhile, AI engines grew sophisticated enough to identify complex patterns and generate remarkably accurate predictions – when given good data.

But here’s what happens in practice: Your Open Banking feed delivers real-time transaction data to one system. Your invoicing software tracks receivables in another. Your payment platform manages payables in a third. Your CRM holds the context about why customers pay when they do. Your AI forecasting tool tries to make sense of exports from each system, usually updated at different intervals with different formats and varying accuracy.

The result? Your cutting-edge AI is making predictions based on a patchwork of disconnected, often contradictory data. It’s like asking a Formula 1 driver to race while looking through multiple mirrors showing different views from different times. The technology is sophisticated, but the input is chaos.

The Power of Unified Data Flows

Now imagine a different scenario: You create solutions where you enter information once and it flows everywhere it needs to go. Your Open Banking feed doesn’t just update a balance – it triggers a cascade of intelligent updates across your entire financial ecosystem.

A customer payment hits your bank account. Instantly:

- Your accounting system matches it to the corresponding invoice

- Your CRM updates the customer payment pattern profile

- Your inventory system adjusts reorder calculations based on improved cash position

- Your payment system reschedules supplier payments for optimal cash utilization

- Your forecasting AI incorporates all of these changes in real-time

This isn’t just integration – it’s orchestration. Every piece of data enriches every other piece, creating a compound intelligence effect that transforms forecasting accuracy.

The Open Banking Fusion Advantage

When Open Banking feeds fuse with integrated business systems, something remarkable happens: context meets real-time data. Your AI doesn’t just see that a payment arrived – it understands:

- Historical Context: How this payment compares to the customer’s usual pattern

- Relationship Dynamics: Recent communications that might affect future payments

- Operational Impact: How this cash influences inventory, hiring, or investment decisions

- Market Conditions: External factors affecting payment timing across your customer base

This contextual awareness transforms AI from a pattern-recognition engine into a true intelligence system. It can predict not just when money will move, but why it might not move as expected.

Breaking the Accuracy Barrier

Traditional cash flow forecasting peaks at about 70% accuracy beyond one week. Integrated Open Banking and AI systems are consistently achieving 90%+ accuracy at 30 days, with useful predictions extending to 90 days. The difference? Data quality and completeness.

Consider how integration improves accuracy at every level:

Data Validation: When multiple systems confirm the same transaction, errors virtually disappear. Your AI trains on verified facts, not potential mistakes.

Pattern Recognition: Integrated data reveals hidden correlations. Maybe customers who open support tickets pay 5 days later on average. Maybe certain email keywords predict early payment. These patterns only emerge when data flows freely between systems.

Real-Time Adjustment: Market conditions change. Customers face challenges. Opportunities arise. Integrated systems mean your AI adapts instantly, not during the next monthly update.

Scenario Modeling: With complete data, AI can run thousands of what-if scenarios in seconds, considering variables across all connected systems to provide probabilistic forecasts with confidence intervals.

The Practical Implementation Path

Building this integrated intelligence doesn’t require starting from scratch. Modern APIs and integration platforms can connect your existing Open Banking feeds with your current business systems. The key is designing data flows that preserve real-time capabilities while ensuring accuracy.

Start with core integrations:

- Connect Open Banking feeds directly to your accounting system

- Link accounting to your CRM for customer context

- Integrate payment platforms for payables visibility

- Connect operational systems for business context

- Layer AI forecasting on top of this integrated foundation

Each connection multiplies the value of the others, creating a network effect that continuously improves forecasting accuracy.

Beyond Forecasting: The Strategic Advantage

When Open Banking, integration, and AI converge, cash flow forecasting becomes just the beginning. This unified intelligence enables:

- Dynamic Working Capital Optimization: Automatically adjust payment timing and credit terms based on real-time cash positions

- Predictive Credit Management: Identify customer payment risks before they materialize

- Automated Treasury Management: Optimize cash deployment across accounts and currencies in real-time

- Strategic Planning: Make investment and growth decisions based on highly accurate long-term cash projections

The Competitive Reality

Businesses still managing cash flow with disconnected systems and monthly forecasts are operating with a massive handicap. While they react to cash crunches, integrated organizations prevent them. While they guess at future positions, AI-powered competitors know with confidence.

The fusion of Open Banking feeds with AI forecasting through intelligent integration isn’t just an operational improvement – it’s a strategic imperative. In a world where cash flow determines survival and growth, the accuracy of your forecasting directly correlates to your competitive advantage.

The technology exists. The data is available. The only question is whether you’ll connect the pieces to create real-time cash flow intelligence, or continue flying blind while your competitors see clearly into the future.